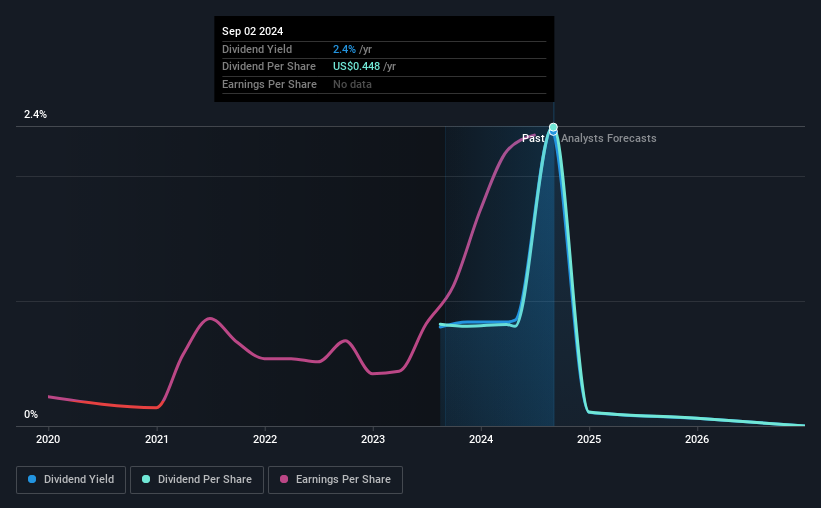

Atour Lifestyle Holdings Limited (NASDAQ:ATAT) has announced that it will be increasing its dividend from last year’s comparable payout on September 30 to CN¥0.40. Based on this payout, the dividend yield for the company is 2.4%, which is fairly typical for the industry.

See our latest analysis for Atour Lifestyle Holdings

Atour Lifestyle Holdings Dividend is Well Covered by Earnings

If the payments are not sustainable, the dividend yield doesn’t mean much. Based on the last payout, Atour Lifestyle Holdings was comfortably earning enough to cover the dividend. This shows that a good part of the earnings is being invested back into the business.

Looking ahead, earnings per share are expected to rise 76.4% in the next year. If the dividend continues in this way, the payout ratio could be 3.0% by next year, which we think could be quite sustainable going forward.

Atour Lifestyle Holdings Does Not Have A Long Payment History

We cannot make a hindsight judgment based on a short payment history. This does not mean that the company cannot pay a good dividend, but that we want to wait until it can prove itself.

The dividend looks set to increase

Some investors will want to buy some of the company’s stock based on its dividend history. It is encouraging to see that Atour Lifestyle Holdings has been growing its earnings per share at 127% per year over the past five years. The company has no problems with growth, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock.

We Like Atour Lifestyle Holdings Dividend

Overall, a dividend increase is always good, and we think Atour Lifestyle Holdings is a solid income stock thanks to its track record and growing earnings. Earnings easily cover distributions, and the company is generating a lot of cash. Overall, this checks a lot of the boxes we look for when choosing an income stock.

Market movements show the high value of a consistent dividend policy compared to an unpredictable policy. At the same time, there are other factors that our readers should be aware of before pouring capital into a stock. For example, we have known 2 warning signs for Atour Lifestyle Holdings that you should be aware of before investing. Isn’t Atour Lifestyle Holdings the opportunity you’ve been looking for? Why not check out our selection of top dividend stocks.

New: Manage Your All Stock Portfolio in One Place

We have the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Wallets and see your total in one currency

• Will be notified of new Warning Signs or Risks by email or mobile phones

• Track the Fair Value of your stocks

Try a Free Demo Portfolio

Do you have feedback about this article? Worried about the content? Get in touch during us directly. Or, email the editorial team at (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using an unbiased methodology only and our article is not intended to be financial advice. It is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to bring you focused, long-term analysis driven by fundamental data. Note that our analysis may not include the latest price-sensitive company announcements or qualitative content. Wall St has no place in any of the stocks mentioned.

#Atour #Lifestyle #Holdings #NASDAQATAT #Shareholders #Receive #Bigger #Dividend #Year